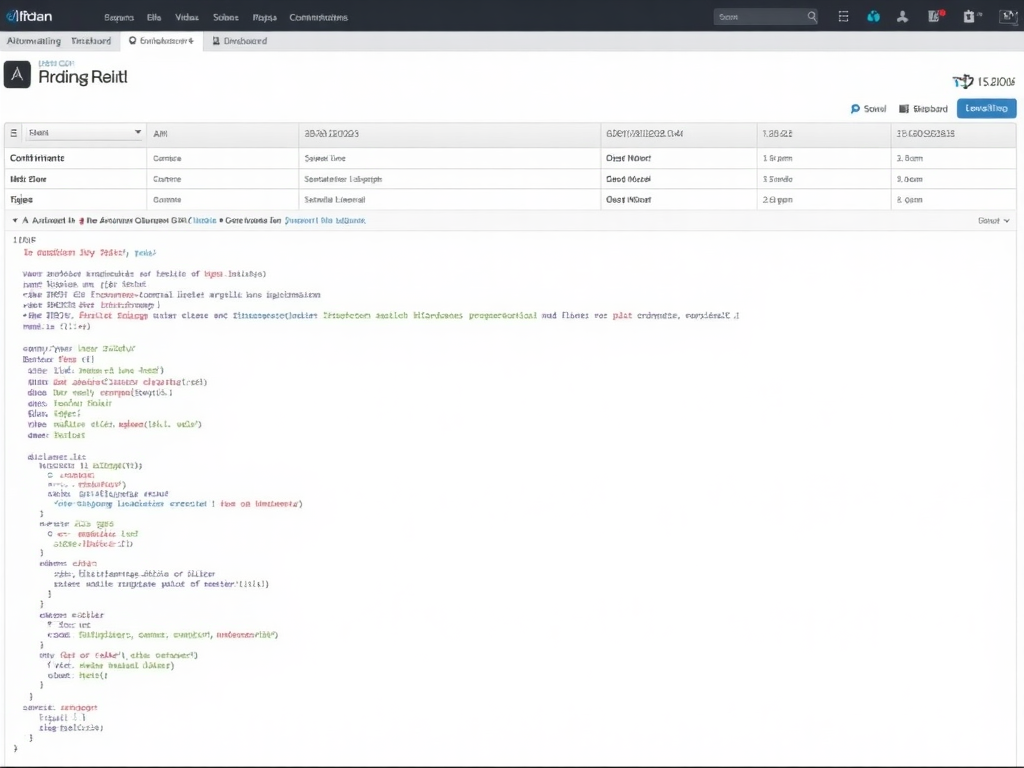

Live trade analysis involves reviewing actual trades in real-time or post-market to improve strategies, refine execution, and build trading discipline. It includes assessing why a trade was taken, the setup involved, risk-reward ratio, entry/exit points, and whether the trade followed your plan. Recording live trades via screen-recording tools or using brokerage statements can help with analysis. Important factors to evaluate include: Did the trade align with your technical/fundamental criteria? Was the timing right? Were the stop-loss and target properly set? Was the trade exited due to emotion or strategy? Over time, this analysis creates a personal playbook that strengthens confidence and reduces repeated mistakes. Many professional traders maintain a trade log to review performance weekly. Live analysis also helps in real-time learning, such as identifying new patterns or market behaviors. The more detailed your analysis, the more you'll improve. Continuous self-feedback is the only way to become a consistent trader.